Intrinsic value (finance)

In finance, intrinsic value refers to the value of a security which is intrinsic to or contained in the security itself. It is also frequently called fundamental value. It is ordinarily calculated by summing the future income generated by the asset, and discounting it to the present value. Simply put, it is the actual value of a security as opposed to the market or book value.

Contents |

Options

An option is said to have intrinsic value if the option is in-the-money. When out-of-the-money, its intrinsic value is zero

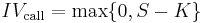

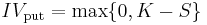

The intrinsic value for an in-the-money option is calculated as the absolute value of the difference between the current price (S) of the underlying and the strike price (K) of the option, floored to zero.

For a call option

while for a put option

For example, if the strike price for a call option is USD $1 and the price of the underlying is USD 1.20, then the option has an intrinsic value of USD 0.20.

The total value of an option is the sum of its intrinsic value and its time value.

Equity

In valuing equity, securities analysts may use fundamental analysis — as opposed to technical analysis — to estimate the intrinsic value of a company. Here the "intrinsic" characteristic considered is the expected cash flow production of the company in question. Intrinsic value is therefore defined to be the present value of all expected future net cash flows to the company; it is calculated via discounted cash flow valuation.

An alternative, though related approach, is to view intrinsic value as the value of a business' ongoing operations, as opposed to its accounting based book value, or break-up value. Warren Buffett is known for his ability to calculate the intrinsic value of a business, and then buy that business when its price is at a discount to its intrinsic value.

Real Estate

In valuing real estate, a similar approach may be used. The "intrinsic value" of real estate is therefore defined as the net present value of all future net cash flows which are foregone by buying a piece of real estate instead of renting it in perpetuity. These cash flows would include rent, inflation, maintenance and property taxes. This calculation can be done using the gordon model.